Everything about Small Business Loans - How you can Obtain Them

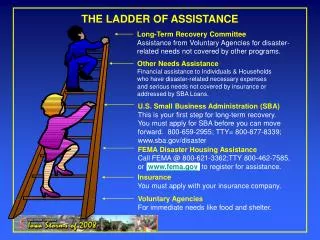

All About Small Business Loans - Ways to Get Them Since we remain to filter dutifully via the over 1,000 pages of the stimulation expense, there is one arrangement that is not obtaining much focus, but could be really valuable to small businesses. If you are a small company and have gotten an SBA loan from your neighborhood lender, but are having difficulty making payments, you can get a "stablizing loan". That's right; ultimately some bailout money goes into the hands of the small company owner, instead of decreasing the typical deep opening of the securities market or big financial institutions. Yet do not obtain as well delighted. It is limited to very specific instances as well as is not readily available for vast bulk of local business owner. Right here is exactly how it works. Presume you was just one of the fortunate few that find a financial institution to earn a SBA loan. You proceed on your cheerful way but encounter hard financial times and also locate it tough to pay off. You will certainly have the ability to obtain a brand-new loan which will certainly pay-off the existing balance on exceptionally positive terms, purchasing more time to revitalize your organisation as well as return in the saddle. Audio as well good to be real? Well, you be the court. Right here are a few of the features: 1. Does not put on SBA loans gotten prior to the stimulus bill. Regarding non-SBA loans, they can be prior to or after the bill's enactment. 2. Does it relate to SBA guaranteed loans or non-SBA standard loans also? We aren't sure without a doubt. This law just says it relates to a "small company concern that meets the eligibility requirements as well as area 7(a) of the Small Business Act" (Section 506 (c) of the brand-new Act). That contains pages and also pages of demands which could apply to both kinds of loans. Based on a few of the preliminary reports from the SBA, it appears it applies to both SBA and also non-SBA loans. If you decide to expand your service operations and also take benefits of potential tax benefits, you need to take into consideration getting business equipment financing, as the financing setup allows you to get, lease or hire a new automobile or specialist devices (e.g. vehicles, vehicles, forklifts, printing, computer, medical and workplace tools as well as plant equipment and machinery). Common money plans to consider for organisation tools money are property lease, commercial hire purchase, capital mortgage or tools service. 3. These loan go through schedule in the financing of Congress. Some assume the means we are opting for our Federal bailout, we are going run out money before the economy we are aiming to conserve. 4. You don't obtain these monies unless you are a sensible company. Boy, you could drive a vehicle with that expression. Our close friends at the SBA will certainly identify if you are "sensible" (picture just how inferior you will be when you need to tell your buddies your business was established by the Federal government to be "non-viable" and on life support). 5. You need to be experiencing "instant financial hardship". So much for holding up paying due to the fact that you prefer to utilize the money for other development demands. How many months you need to be overdue, or just how close your foot is to the banana peel of total service failing, is any individual's assumption.

★

★

★

★

★

73 views • 2 slides