Mastering Bad Debt Write-Offs in QuickBooks 2023_ A Detailed Walkthrough

0 likes | 20 Views

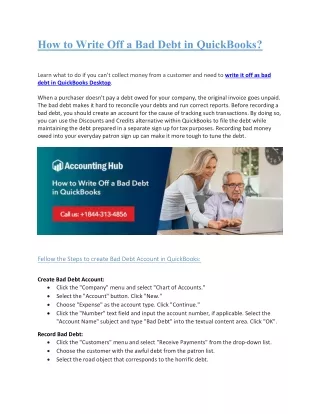

Unlock the ultimate solution for QuickBooks Error 15222 in 2023 with our comprehensive guide. Delve into the root causes, symptoms, and step-by-step resolutions to overcome this notorious obstacle. From troubleshooting Internet Explorer settings to verifying digital signatures and updating QuickBooks software, our guide provides a systematic approach to tackle this error effectively. Say goodbye to update failures and disruptions in your QuickBooks workflow. With our expert insights, navigate QuickBooks Error 15222 with confidence and ensure seamless financial management in the year 2023.<br>

Download Presentation

Mastering Bad Debt Write-Offs in QuickBooks 2023_ A Detailed Walkthrough

An Image/Link below is provided (as is) to download presentation

Download Policy: Content on the Website is provided to you AS IS for your information and personal use and may not be sold / licensed / shared on other websites without getting consent from its author.

Content is provided to you AS IS for your information and personal use only.

Download presentation by click this link.

While downloading, if for some reason you are not able to download a presentation, the publisher may have deleted the file from their server.

During download, if you can't get a presentation, the file might be deleted by the publisher.

E N D

Presentation Transcript

More Related