Corporate tax in UAE

20 likes | 83 Views

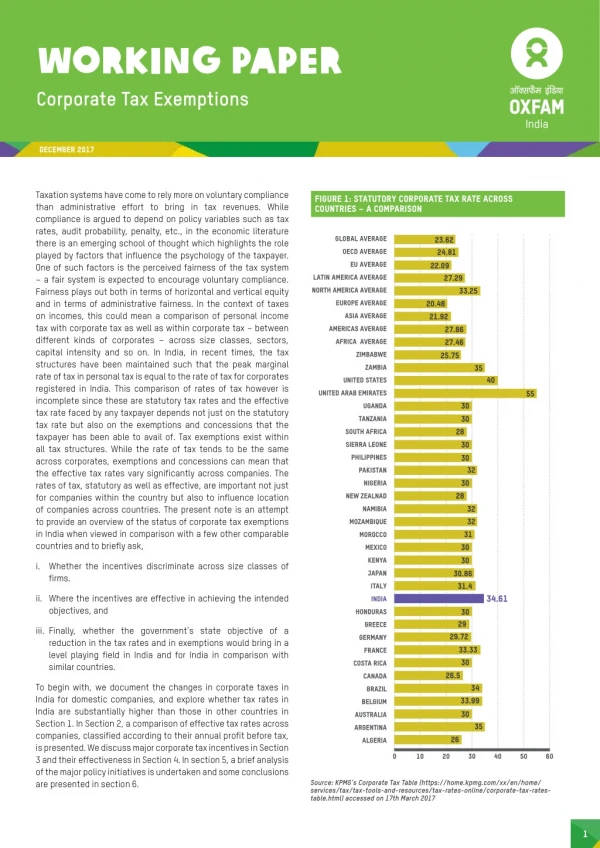

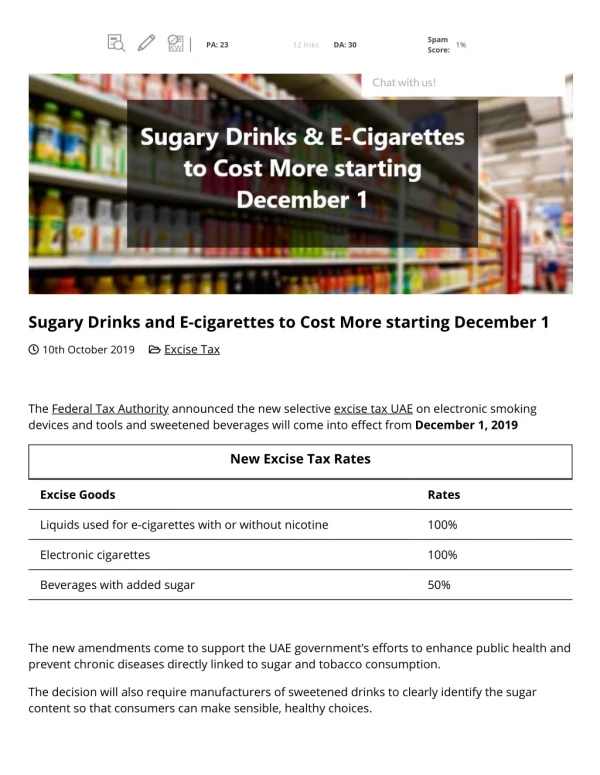

As of my last training data in September 2021, the United Arab Emirates (UAE) is recognized globally for its unique, business-friendly tax regime. Unlike many countries, the UAE does not have a federal corporate income tax (CIT) levied on all companies. Rather, Corporate taxation in the UAE is limited and sector-specific.<br>Primarily, the corporate tax is imposed on oil and gas production companies, as well as branches of foreign banks. Oil companies are taxed on their UAE-sourced income, with rates specified in the concessions agreements, typically ranging from 55% to 85%. Foreign banks' branch

Download Presentation

Corporate tax in UAE

An Image/Link below is provided (as is) to download presentation

Download Policy: Content on the Website is provided to you AS IS for your information and personal use and may not be sold / licensed / shared on other websites without getting consent from its author.

Content is provided to you AS IS for your information and personal use only.

Download presentation by click this link.

While downloading, if for some reason you are not able to download a presentation, the publisher may have deleted the file from their server.

During download, if you can't get a presentation, the file might be deleted by the publisher.

E N D

Presentation Transcript

More Related