Pristine Limited (PL) manufactures and sells fireproof safes and document containers of various shapes and sizes for hom

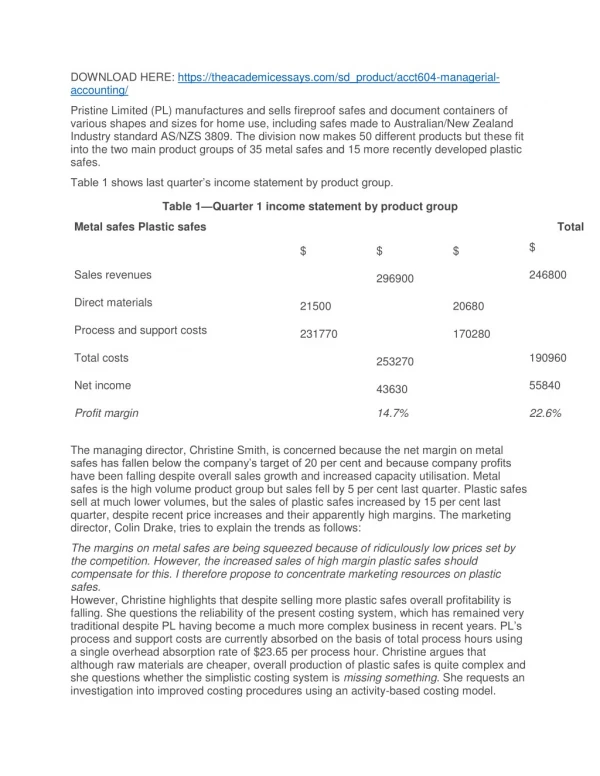

DOWNLOAD HERE: https://theacademicessays.com/sd_product/acct604-managerial-accounting/ Pristine Limited (PL) manufactures and sells fireproof safes and document containers of various shapes and sizes for home use, including safes made to Australian/New Zealand Industry standard AS/NZS 3809. The division now makes 50 different products but these fit into the two main product groups of 35 metal safes and 15 more recently developed plastic safes. Table 1 shows last quarter’s income statement by product group. Table 1—Quarter 1 income statement by product group Metal safes Plastic safes Total $ $ $ $ $ $ Sales revenues 296900 246800 543700 Direct materials 21500 20680 42180 Process and support costs 231770 170280 402050 Total costs 253270 190960 444230 Net income 43630 55840 99470 Profit margin 14.7% 22.6% 18.3% The managing director, Christine Smith, is concerned because the net margin on metal safes has fallen below the company’s target of 20 per cent and because company profits have been falling despite overall sales growth and increased capacity utilisation. Metal safes is the high volume product group but sales fell by 5 per cent last quarter. Plastic safes sell at much lower volumes, but the sales of plastic safes increased by 15 per cent last quarter, despite recent price increases and their apparently high margins. The marketing director, Colin Drake, tries to explain the trends as follows: The margins on metal safes are being squeezed because of ridiculously low prices set by the competition. However, the increased sales of high margin plastic safes should compensate for this. I therefore propose to concentrate marketing resources on plastic safes. However, Christine highlights that despite selling more plastic safes overall profitability is falling. She questions the reliability of the present costing system, which has remained very traditional despite PL having become a much more complex business in recent years. PL’s process and support costs are currently absorbed on the basis of total process hours using a single overhead absorption rate of $23.65 per process hour. Christine argues that although raw materials are cheaper, overall production of plastic safes is quite complex and she questions whether the simplistic costing system is missing something. She requests an investigation into improved costing procedures using an activity-based costing model. It is established that there are five main activities undertaken by PL. Table 2 shows details of these activities, their cost drivers and their estimated costs per quarter. Table 2—D Activity ata on key activities Cost driver Estimated costs Insulation process Insulation process hours $ 180700 Assembly process Assembly process hours 69600 Quality control Number of inspections 80080 Materials management Number of requisitions 47800 Selling and administration Number of sales orders 23870 Total process and support costs 402050 Table 3 shows last quarter’s actual activity rates. Table 3—Act Activity ivity rates for the Metal safes last quarter Plastic safes Total activity Insulation process hours 7000 6000 13000 Assembly hours 2800 1200 4000 Total process hours 9800 7200 17000 Number of inspections 40 100 140 Number of requisitions 300 700 1000 Number of sales orders 30 47 77 The assembly process for plastic safes is quite complex and there has recently been a high level of rejects. This has resulted in the need for increased quality control activities. Plastic safes generally comprise more components than metal safes, causing more material movements. The plastic safe product group is still new and PL’s customer base is characterised by a large number of customers each ordering small volumes. REQUIRED: 1) Explain TWO general problems associated with Pristine Limited’s traditional costing system. (4 marks) 2) Highlight FOUR indicators that the current costing system is outdated and flawed. (8 marks) 3) Calculate the activity cost rates to be used in the desired activity-based costing system. (5 marks) 4) Prepare a revised income statement by product group tracing process and support costs to product groups using activity-based costing methodology. (15 marks) 5) Briefly explain the differences in product costs and net profit margins between the two alternative costing systems. (6 marks) 6) State the benefits, costs and issues of adopting the activity- based costing system to Pristine Limited. (8 marks)

★

★

★

★

★

72 views • 3 slides