Cost Of An Employee Understanding The Payroll System In Germany

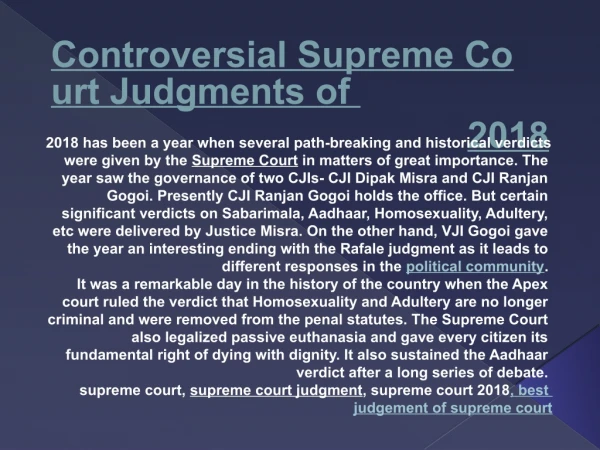

Germany offers an access to its large and well-educated population to a lot of businesses which makes the process of Company Formation in Germany a lucrative option. However, there are number of complicated processes involved in executing and launching a German payroll system. Here are a few things that you can keep in mind in order to ensure a successful payroll system in Germany: Getting Started Employee Payments Tax Collection Employment Law Germany’s Employment Law defines many policies regarding the payroll. It dictates that every employee should have the option to join a union, collective labor agreement, or work council, which would play an important role in issues relating to shift timings, wages etc. (but only if you have a certain number of employees in Germany). As of January 1, 2017, the law defines the minimum Cost of Employee in Germany as €8.84 per hour subjecting to certain exceptions based on employees’ age, status etc. One of the most important jobswhen it comes to payroll is to calculate the income tax due for each employee and to pay the withheld amount to authorities. The employer must withhold the calculated amount from employees’ gross payments each month and then submit that payment to the appropriate tax office by the 10th of the following month. Failure to do this will result in you being charged with a penalty.

★

★

★

★

★

146 views • 12 slides