VAT Refunds For Non-UK Businesses - Tax Librarian

100 likes | 128 Views

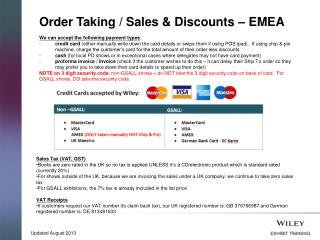

If you are not a member of the EU and purchasing goods in the European Union (EU), you most likely indirectly paid VAT on goods in that country. You may be eligible for a refund if you have paid unnecessary taxes on goods purchased in the European Union and file VAT refunds for Non-UK businesses. If you are not familiar with tax laws and do not want to know everything about the EU VAT refund process, we can help you get your money back. Call us at 44 207 167 4301 or visit here: https://www.taxlibrarian.co.uk/services-item/vat-refunds-for-non-eu-businesses-visiting-the-uk/

Download Presentation

VAT Refunds For Non-UK Businesses - Tax Librarian

An Image/Link below is provided (as is) to download presentation

Download Policy: Content on the Website is provided to you AS IS for your information and personal use and may not be sold / licensed / shared on other websites without getting consent from its author.

Content is provided to you AS IS for your information and personal use only.

Download presentation by click this link.

While downloading, if for some reason you are not able to download a presentation, the publisher may have deleted the file from their server.

During download, if you can't get a presentation, the file might be deleted by the publisher.

E N D

Presentation Transcript

More Related